If you need extra cash, a personal loan can give you the financial freedom you require. Whether it’s for home renovations, to cover an unexpected expense, to make an investment, or to give you some financial room, a personal loan can provide you with a long-term financing option to use however you wish.

With a personal loan, the money you borrow must be repaid over time, typically with interest and additional fees. If you’re considering this type of loan, you may be curious about the process. Keep reading this blog article to learn more about personal loans, their benefits, and how to apply.

What Is a Personal Loan?

Personal loans, also called long-term financing plans, installment loans, or consumer loans, are a type of loan where money is borrowed from a lender. Personal loans can be used for nearly any purpose.

When you take out a personal loan, you agree to borrow a specific amount of money and pay back the loan, interest, and any other applicable fees over an agreed-upon amount of time. You do this by making regular payments, called installments, to the lender.

Personal loan amounts can range from $1,000 to $100,000 with a term between 6 and 60 months, depending on the lender.

Types of Personal Loans

There are 2 types of personal loans.

Secured Loans

An asset backs a secured personal loan as a promise to your lender that you will repay the loan. This asset is called collateral. If you can’t make your payments, the lender can take the asset from you.

Unsecured Loans

An unsecured personal loan doesn’t require collateral, and is only backed by a signed contract or agreement. Unlike a secured loan, the lender will have no asset to take from you if you fail to pay back your loan. Instead, the lender can use legal means to receive payment.

The Difference Between Secured & Unsecured Loans

Other than use of collateral, some other differences between a secured loan and an unsecured loan include:

- Secured loans will typically allow you to borrow a higher amount, instead of offering lower interest rates

- You can take advantage of longer loan terms with a secured loan

- Secured loans allow you to borrow more if your security is worth more; Typically, a lender will go up to 50% of what your collateral is worth

What Are the Benefits of Personal Loans?

Personal loans offer many benefits over other financing options.

You Can Get Your Loan in One Lump Sum

Personal loans are typically given all at once. If you’re using a personal loan to make a large purchase, personal loans make it easy to do.

Personal Loans Are Easy to Manage

Because you get personal loan payment in one lump sum, it can be easier to predict your payback rates and monthly payments. This makes repaying your loan easier to manage.

Personal Loans Typically Have Fast Approval Times

Personal loans generally have faster approval times and payment times compared to other financing options. If you’re using a personal loan to cover an unexpected expense or an emergency, personal loans can give you access to money fairly quickly.

Collateral Isn’t Always Required

There are 2 types of personal loans: secured loans and unsecured loans. If you don’t want to borrow money against an asset, an unsecured personal loan gives you the ability to get approved without relying on collateral.

Personal Loans Have Lower Interest Rates Compared to Credit Cards

Personal loans often come with lower interest rates than credit cards. As of July 2022, the average personal loan rate was 10.28%, while the average credit card rate was 16.80%. Consumers with excellent credit history can qualify for personal loan rates of around 10.3–12.5%. You may also qualify for a higher loan amount than the limit on your credit cards.

You Can Enjoy Flexibility & Versatility

Personal loans can be used for all sorts of expenses, from financing a wedding to giving you a little bit of extra wiggle room financially. No matter why you need money, a personal loan can help.

Applying for a Personal Loan

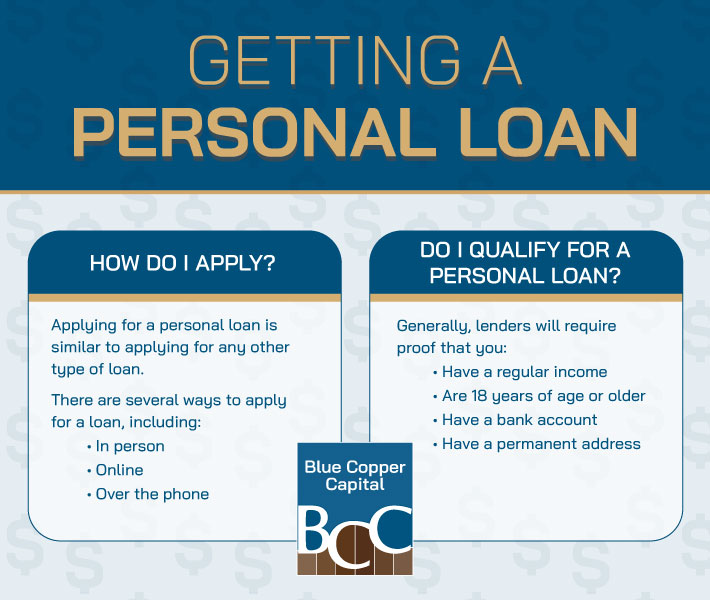

Applying for a personal loan is similar to applying for any other type of loan, including applying for a credit card.

There are several ways to apply for a loan, including:

- In person

- Online

- Over the phone

Generally, lenders will require proof that you:

- Have a regular income

- Are 18 years of age or older

- Have a bank account

- Have a permanent address

If you have any additional questions about personal loans, or you’re ready to apply, contact our team at Blue Copper Capital. We’re always here to help.