The Canada Emergency Response Benefit (CERB) has been closed for several months now, but some may still be dealing with the complications. If you’ve received unintended CERB payments, a financial advisor can help you determine your best options, and provide needed support if you’re having difficulties managing repayment. Learn more about what to do if you receive too much CERB, below.

How Does a CERB Overpayment Happen?

A CERB overpayment can happen for a variety of reasons. Most likely, there was a missed eligibility requirement such as:

- You earned more from your employment than initially anticipated

- You received two CERB payments, one from Service Canada & one from the CRA

- You applied for CERB but were not eligible

If you accidentally received too much CERB, the government will expect reimbursement of any money owed to them. If you haven’t spent the money or can afford to pay back the overpayment, it is recommended to do so as soon as possible.

If there were any mistakes made with your CERB payments, you have or likely will receive a letter or phone call about your repayment as the original deadline for any repayments was set for December 31, 2020.

CERB may have been discontinued, but there are potential implications for your taxes if you haven’t repaid your debt. If you’ve received more than your eligible share, there is important information to know regarding your 2020 income taxes.

How Do Repayments Affect Your Taxes?

Your CERB payments account for your taxable income and must be included when calculating your 2020 income taxes. If you aren’t self-employed, expect to receive a T4 from the CRA or Service Canada.

The amount of tax you pay depends on how much income you earned. After the December 31, 2020 deadline, any CERB payments (including overpayments) will be taxed. Your repayment will be on your 2021 T4A slip, and you can claim this as a deduction on next year’s tax return.

What to do

Your next steps depend on which agency originally paid you your CERB payment, the CRA or Service Canada.

If you applied for CERB with the CRA you will receive a T4A information slip detailing all COVID-19 benefits provided to you (Quebec residents will relieve a T4A slip and an RL-1 slip). Your T4A can also be reached through your CRA account. You should follow the following steps for filing your taxes:

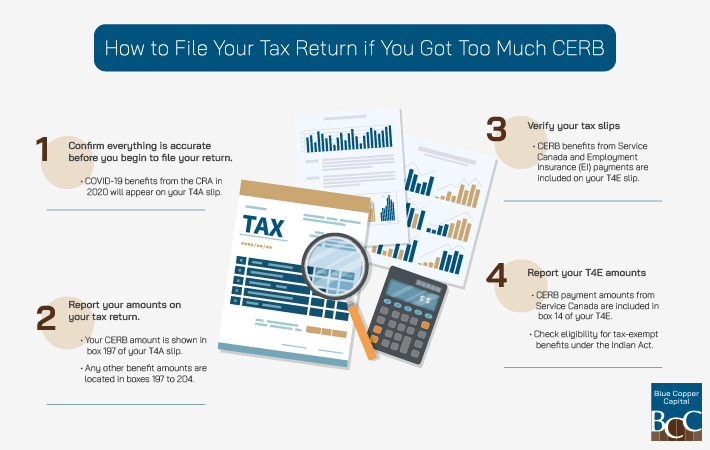

Verify your tax slips

Your COVID-19 benefits from the CRA in 2020 will appear on your T4A slip. Confirm everything is accurate before you begin to file your return. These T4A slips only apply to federal payments, any provincial or territorial COVID-19 benefits will be on separate slips.

Report your amounts on your tax return

Your CERB amount is shown in box 197 of your T4A slip, and any other benefit amounts are located in boxes 197 to 204. Calculate all of the benefit payments between the identified boxes and enter the total on line 1300.

Filing your taxes if you’ve received benefits through Service Canada is a similar process with some minor differences. If you received CERB from this provider, the next steps can ensure you file your tax return correctly.

If you’ve received CERB payments from Service Canada, you will receive a T4E slip (Quebec residents will receive a T4E and a T4E(Q) slip). Your slip can also be obtained through your Service Canada account. If you’re filing benefits from Service Canada, follow these steps:

Verify your tax slips

Any CERB benefits from Service Canada and Employment Insurance (EI) payments are included on your T4E slip. Confirm the accuracy of your T4E slip before beginning your tax return.

Report your T4E amounts

CERB payment amounts from Service Canada are included in box 14 of your T4E. The total includes amounts from CERB and any employment insurance benefits.

If you are not eligible for tax-exempt benefits under the Indian Act, take the amount in box 14 and subtract any amount from box 18 (“other information” on your T4E). Enter the subtracted total into line 11900 on your tax return.

If you missed the initial December 31, 2020 deadline for CERB repayment, your taxes may be affected, but it’s essential to repay your CERB debt. Thankfully, there are a variety of ways to do this.

How Can You Repay CERB?

If you applied and received CERB from the CRA and Service Canada during the same eligibility period, return or repay your CERB to the CRA. There are two main methods of repaying CERB: making the entirety of the payment or utilizing a payment plan.

Direct payment

There are several ways to repay your debt, including:

- By mail

- Online

- In-person

You can repay your debt in full, or you can make a minimum monthly payment listed on your statement of account. If you’re unable to make these payments, contact the CRA for help developing a potential payment plan.

Payment plan

A payment arrangement can be made if you are unable to pay the minimum payment listed by your statement of account. A payment plan is an agreement between you and the CRA to pay your debt at a reduced payment rate over a specific period. It is vital to pay as agreed, file all returns, and keep up on your tax obligations.

If you cannot pay for basic needs (housing, food, utilities) while repaying your debt, consider applying for financial hardship provisions.

Financial hardship provision

If you cannot afford your basic needs while repaying your debt, contact the CRA to discuss the appropriate action. These actions can include renegotiation of a payment plan or suspension of collection activity. Other measures may be taken depending on your financial situation.

Repay Your Debts & Remove Your Stress

If you have any outstanding CERB debt, make plans to repay them as soon as possible. No one wants to be in trouble with the CRA, and if you’re unsure of what to do, consider speaking with a trusted financial advisor to identify your potential options.