Inflation isn’t just a buzzword thrown around by economists and news anchors—it’s a real financial force that can quietly eat away at your savings and investments. Understanding inflation has never been more critical for Canadians, especially considering its recent uptick.

Inflation can significantly impact savings and investments by eroding the purchasing power of money over time. Financial literacy is important, especially during times of inflation, as understanding how inflation affects savings, investments, and overall purchasing power enables individuals to make informed financial decisions to protect and grow their wealth effectively.

What Is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of money. Essentially, it means that over time, your money buys less than it used to. If inflation is at 2%, a $1 loaf of bread will cost $1.02 next year.

Inflation in Canada

Canada has experienced varying rates of inflation over the years. Recently, Alberta has seen a noticeable increase in the cost of living, with housing and energy prices driving the surge. British Columbia hasn’t been spared either—especially in Vancouver. The rising costs have impacted everything from groceries to real estate, putting pressure on household budgets.

The Value of Money

When inflation rises, the value of money diminishes. Think of it like this—if you store $100 under your mattress, that money will lose value each year if inflation is present. After 10 years, your $100 won’t stretch as far as it did when you first saved it. This erosion of purchasing power makes understanding and counteracting inflation essential for anyone looking to maintain their financial health.

How Does Inflation Impact Savings?

Inflation can be particularly harsh on traditional savings accounts. Most savings accounts offer lower interest rates than the current inflation rate. If inflation is at 3% and your savings account offers a 1% interest rate, your money’s real value is effectively decreasing by 2% each year. Over time, this can significantly impact your financial security.

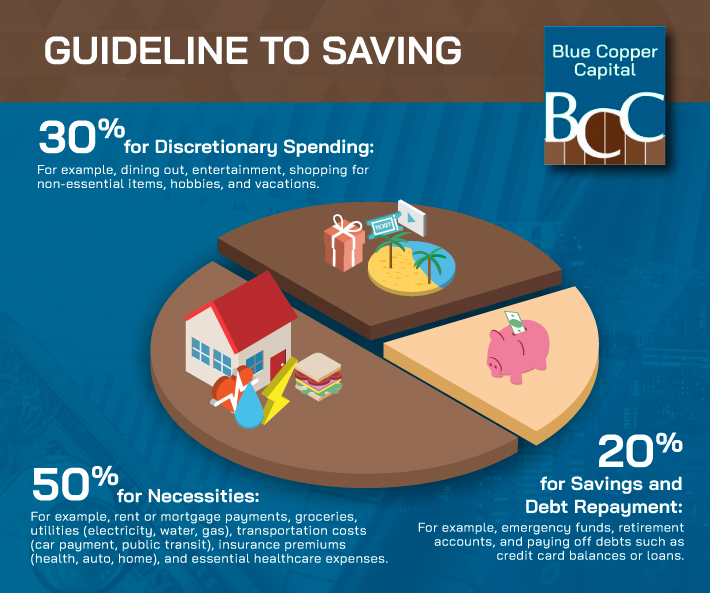

The 50/30/20 Savings Rule

One way to manage your finances amid inflation is by following the 50/30/20 rule:

- 50% of your income goes to necessities like rent, groceries, and utilities.

- 30% goes to discretionary spending—think dining out or entertainment.

- 20% is dedicated to savings and debt repayment.

While this method helps make sure you save consistently, it’s important to seek higher-yield savings options to counteract inflation’s impact.

How Does Inflation Impact Investments?

Investments aren’t immune to inflation either. Fixed-income investments like bonds often suffer because their returns may not keep up with rising prices. On the other hand, stocks can offer some protection as companies may pass on higher costs to consumers, potentially boosting revenue and stock prices. However, the market remains volatile and unpredictable.

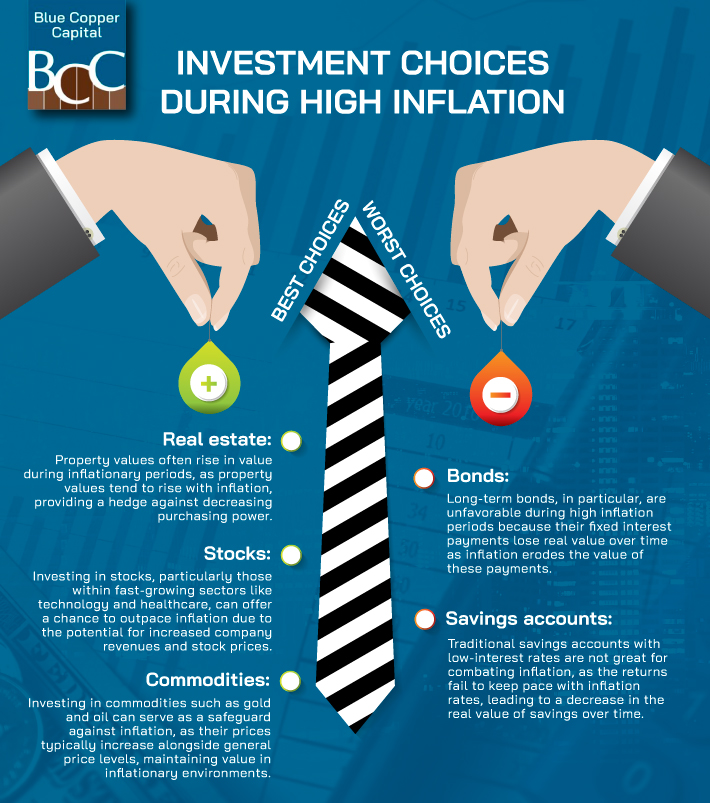

Best & Worst Investment Choices During High Inflation

During periods of high inflation, certain investments tend to perform better than others.

Best Choices

- Real estate: Property values typically rise with inflation.

- Stocks: Particularly those in sectors like technology and healthcare, which can outpace inflation.

- Commodities: Investing in commodities like gold and oil can protect against inflation as their prices rise with general price levels.

Worst Choices

- Bonds: Especially long-term bonds, as their fixed interest payments lose value over time.

- Savings accounts: Traditional savings accounts with low interest rates fail to keep pace with inflation, diminishing your purchasing power.

Counteracting Inflation

To protect your savings and investments against inflation, consider these strategies:

- Diversify your portfolio: Spread your investments across various asset classes, like stocks, real estate, and commodities.

- Seek inflation-protected securities: Some bonds adjust their value based on inflation.

- Invest in hard assets: Real estate and commodities often retain value better during inflationary periods.

- Increase contributions: Regularly increase how much you’re saving or investing to offset inflation’s impact.

Are There Any Positives of Inflation?

While inflation can seem daunting, it isn’t entirely negative. For one, moderate inflation is a sign of a growing economy. When prices rise slightly, it often suggests that consumers are spending more, which can stimulate economic activity and job creation.

Inflation can also benefit borrowers as the real value of debt decreases over time. As prices increase, the fixed amount of debt becomes relatively smaller in terms of purchasing power, making it easier for borrowers to repay their debts.

Additionally, if your income grows faster than inflation, you can actually end up in a better financial position. This means that if your salary increases to match or exceed the inflation rate, you can maintain or enhance your purchasing power, potentially leading to increased savings or investments.

Understanding Inflation

Understanding the impact of inflation on your savings and investments is crucial for maintaining your financial health. By being proactive, diversifying your portfolio, and seeking higher-yield savings options, you can mitigate the adverse effects of inflation. For personalized advice and more tips on managing your finances, contact Blue Copper Capital today. We’re here to help you safeguard your financial future.