Budgeting can feel like a juggling act. Recent data suggests that as many as 41% of working Canadians are financially stressed as of 2025.

It’s important to create a plan for your expenses to ensure you have enough money for the things you need. Whether you just went through a life change, growing your business, or helping out your family between paychecks, you can find benefits from budgeting.

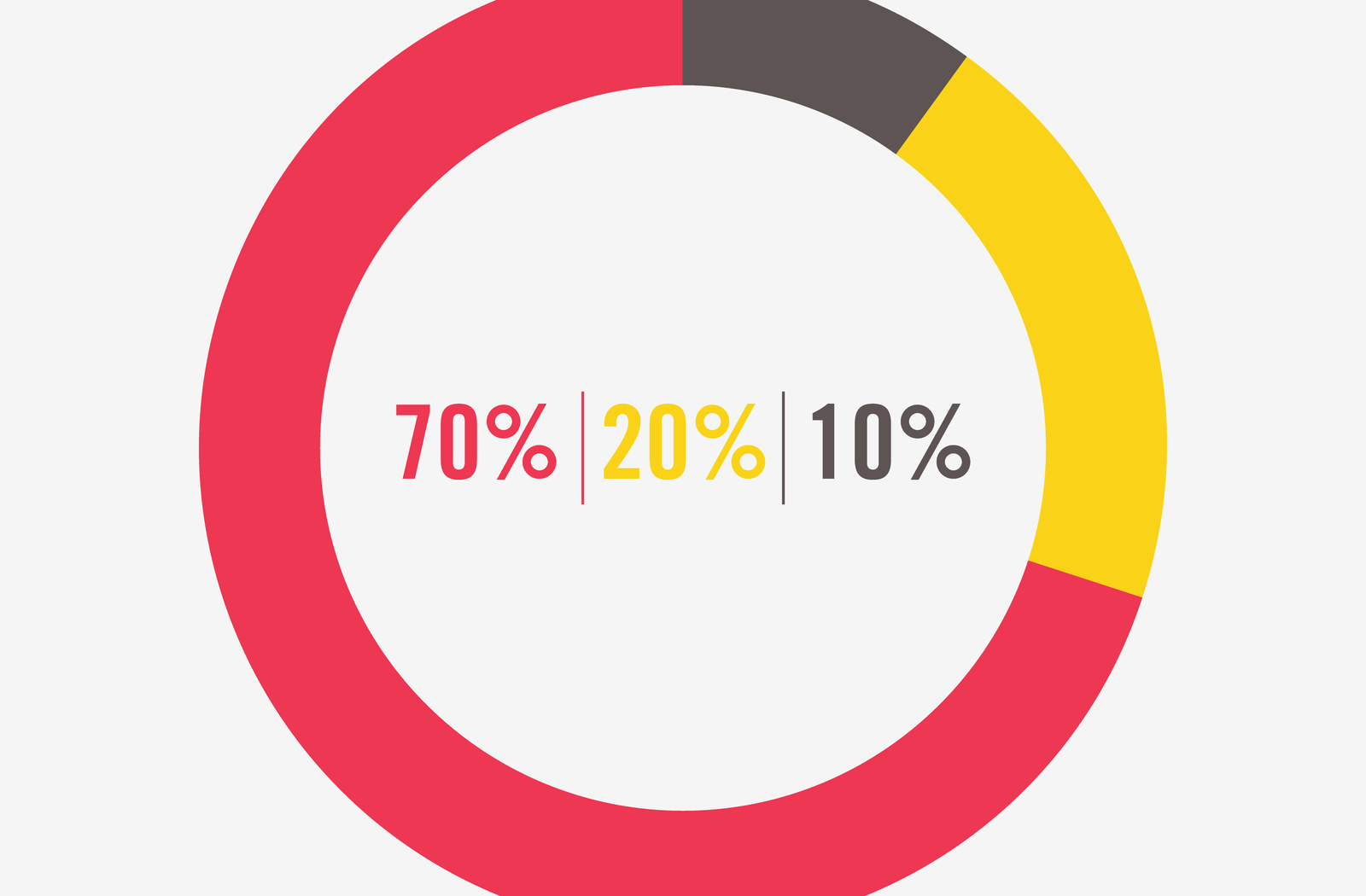

The 70/20/10 rule is an easy way to break down your paycheque to allocate money where it’s needed.

Why Is It Becoming Important to Budget

Due to recent economic shifts in the Canadian economy, it is proving to be more and more essential to plan your future expenses to ensure financial security. This is where budgeting can help prevent unexpected expenses from springing up on you. When considering both current and future income and expenses, you can create a plan that will help you sleep better at night.

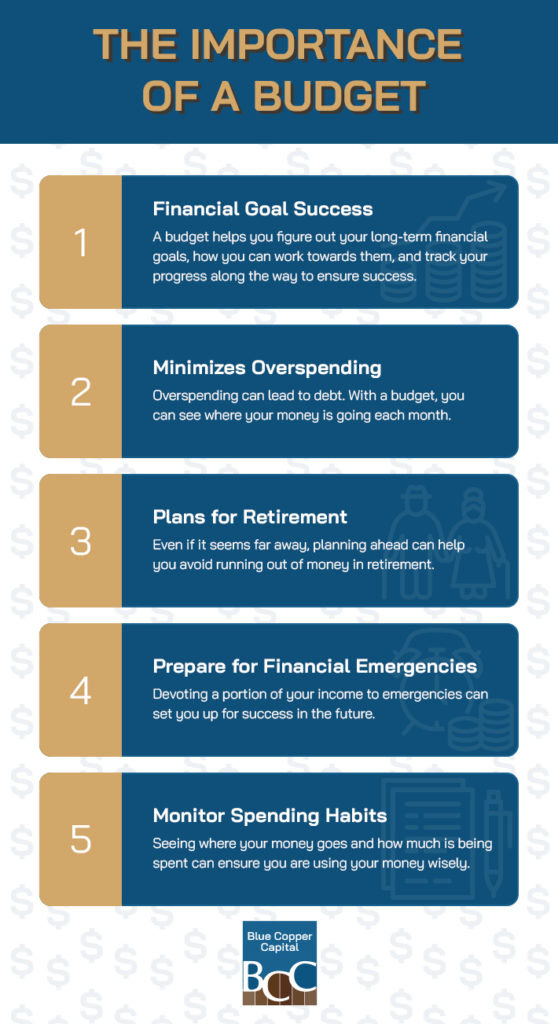

Some advantages to creating a budget include:

- It helps you figure out your long-term goals, how to work towards them, and track your progress along the way

- Ensures you aren’t overspending leading to debt

- Plans for retirement

- Can prepare you for financial emergencies

- Allows you to monitor spending habits

If you have taken out a loan to meet short or long-term financial needs, a budget can help you repay that loan. There are many benefits to paying your loan early, like good credit history and decreasing the amount of interest you pay.

Breaking Down the 70/20/10 Rule

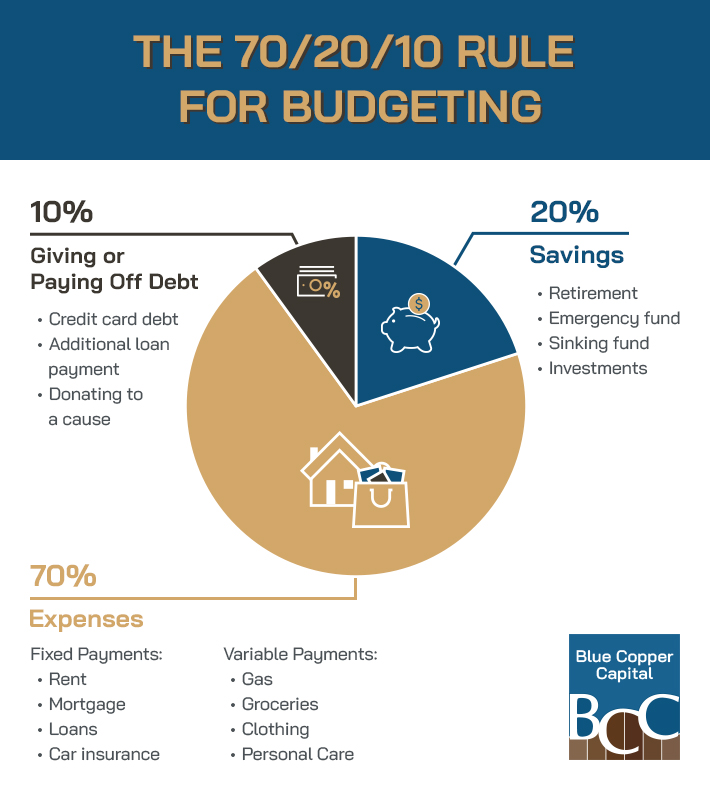

The 70/20/10 rule is a simple way to help you feel in control of your money. Each number represents a percentage of your paycheque to allocate to a specific category: spending, saving, and giving or paying off debt.

Let’s break down these categories further.

Types of Expenses

70% of your income will be devoted to expenses. Anything you spend money on falls into this category. If that sounds overwhelming, you can further break down your spending into variable vs. fixed expenses.

Fixed expenses have a set amount of money you pay every month. The amount is unlikely to change. This can include:

- Rent or mortgage payments

- Car payment

- Insurance

- Cell phone service

- Internet service

- Childcare expenses

- Loan payments

Variable expenses can change month to month depending on your lifestyle or from factors out of your control. This can include:

- Gas

- Groceries

- Clothing

- Dining out

- Healthcare expenses

- Personal care expenses

- Entertainment

For the 70/20/10 rule, the goal is to keep your expenses to 70% or below. See where your money is going each month and track your spending habits. If you have money left over, you can allocate it to another category.

Saving

20% of your income will be devoted to saving. Saving can help set your future self up for success. Some saving goals to prepare for can include:

- Retirement

- College fund for kids

- Emergency fund

- Sinking fund

- Investments

Setting financial goals can help you establish your budget and plan your savings.

Giving or Paying Off Debt

10% of your income will be devoted to giving, paying off debt, or both. Paying off credit card debt, repaying a personal or business loan, or donating to a cause you’re passionate about all fall under this category.

If you have accumulated debt, you might consider the snowball or avalanche method. The debt snowball means you pay off your debts in order from smallest to largest, while the avalanche method looks at interest rates, paying off the highest rates first.

An Example of the 70/20/10 Rule

When utilizing the 70/20/10 rule for budgeting, there’s a little math involved, but don’t worry, it’s simple!

Use a calculator to figure out each percentage based on your monthly income. To do this, multiply your monthly income by 0.7 for expenses, 0.2 for savings, and 0.1 for paying off debt or donating.

Let’s say you make $3000 a month. Your budget breakdown would look like this:

- $2100 towards expenses

- $600 towards savings

- $300 towards debt or donation

It’s up to you how you want to spend the money in each category.

Reassessing Your Spending in the Face of Inflation

With inflation driving up the cost of everyday goods and services, it’s more important than ever to reassess your spending habits. The 70% of your budget allocated to expenses may no longer stretch as far as it used to. Take a closer look at your spending categories, such as groceries, transportation, and utilities, to identify areas where price increases are impacting your budget.

Adjusting your expenses—whether by finding cheaper alternatives, reducing discretionary spending, or prioritizing essentials—can help you stay within your budget and prevent overspending. Staying mindful of these changes can keep you financially secure, even as the cost of living rises.

Is the 70/20/10 Budget Right for You?

There are significant benefits to budgeting your money. This budgeting style is excellent when it comes to planning for the future and paying down debt. With a budget in place, you can feel confident about paying back a loan. Try out the 70/20/10 next month and see if it’s right for you.