Small business owners often find themselves at the crossroads of personal and professional finances, particularly when seeking to expand their operations.

Entrepreneurs navigating the complexities of credit inevitably ponder over how this decision will ripple across their personal financial landscape. A business loan can affect your personal credit but may not always do so, depending on several factors.

When small business owners personally guarantee a business loan, they make themselves directly liable for the debt. However, responsible management of both personal and business finances can minimize negative effects and possibly help improve your credit over time.

The Importance of Business Credit

For business longevity and growth, establishing solid business credit is non-negotiable. Your business’s ability to access funds, secure favourable terms, and ultimately thrive is highly contingent on your business credit profile.

However, this aspect of entrepreneurism is often overshadowed by day-to-day operational challenges. Understanding and nurturing business credit not only separates your professional finances from your personal but also lays the foundation for future aspirations.

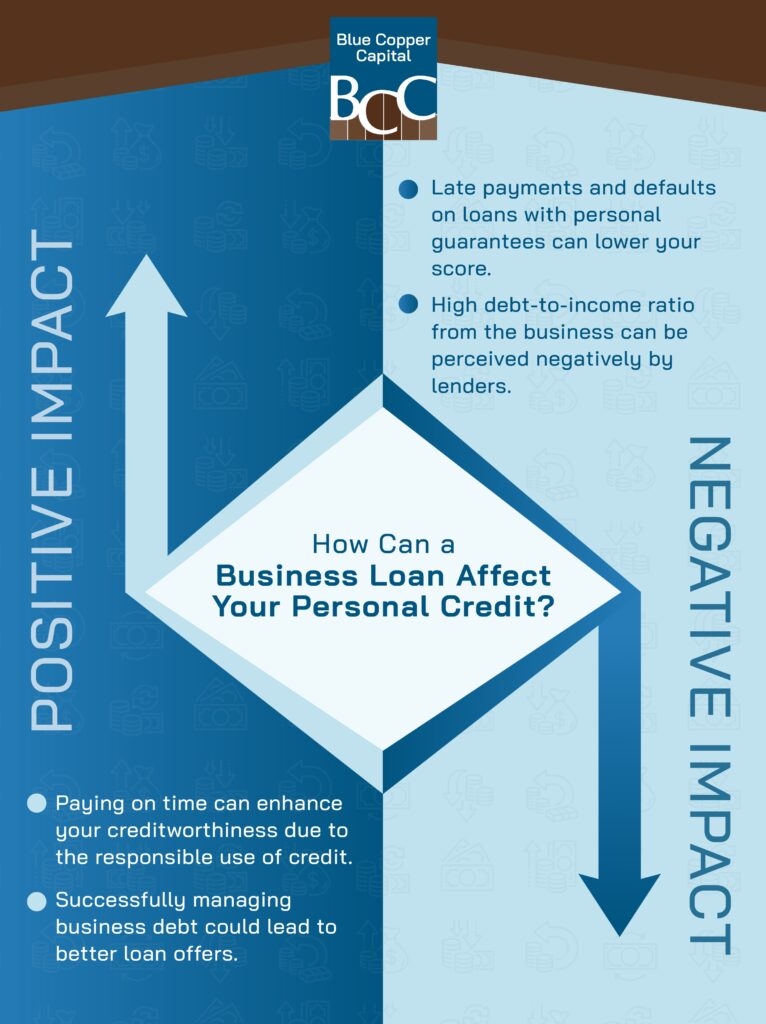

How Can a Business Loan Affect Personal Credit?

While business loans can affect personal credit, this is not always the case. How your loan affects your personal credit depends on a few things, including how your credit score is checked and the reporting practices of your lender.

Impact on Credit Score

When evaluating business loans, it’s natural to be concerned about your personal credit. Your personal credit score often serves as an influential factor for lenders assessing your eligibility.

Taking out a business loan can impact your score in several ways. Initially, when you apply for the loan, the lender will perform a hard inquiry into your credit reports, which may lead to a slight, temporary dip in your credit score. However, if you make timely payments on the business loan, it could actually improve your personal credit score over time.

Reporting Practices of Lenders

In the realm of reporting practices, not all lenders are created equal. Traditional banks are apt to report your business loan to commercial credit bureaus like Equifax or TransUnion, which do not affect your personal credit.

However, many alternative lenders do report to consumer credit bureaus, potentially impacting your personal credit score. Staying informed about a lender’s reporting practices is crucial in the decision-making process.

When Your Credit Score Won’t Be Affected

If the business loan is solely in the name of the business, without a personal guarantee, and the lending institution reports only to business credit bureaus, your personal credit score may remain unaffected. Additionally, loans from lenders who do not report to the personal credit bureaus may also not impact your personal credit score.

Tips for Safeguarding Personal Credit while Taking a Business Loan

To mitigate any adverse impact on your personal credit, adopt a strategic approach. Maintain a low personal credit utilization ratio, make timely payments on all personal accounts, and consider the overall affordability of the business loan. Effective loan management can help protect and enhance your personal credit health.

Establishing a Separate Business Identity

One effective strategy to minimize the impact of business financial activities on personal credit is to establish a distinct identity for your business. This can be accomplished by incorporating your business to separate your personal assets from those of your business.

It’s also a good idea to acquire a federal business number and open business banking accounts in the name of the corporation, using its business number. These actions are essential for developing business credit that is independent from your personal credit, safeguarding your personal financial standing.

Proactive Financial Management Practices

Adopting proactive financial management practices is vital for protecting your personal credit while handling a business loan. This includes:

- Regular Credit Monitoring: Keep a vigilant eye on both your personal and business credit reports. Understanding your credit status will help you address any issues promptly and maintain a healthy credit profile.

- Strategic Planning & Budgeting: Accurate financial planning and budgeting are essential. They can help you foresee cash flow challenges and avoid late payments on both personal and business debts.

- Emergency Funds: Establishing a business emergency fund can provide a buffer that helps you make timely loan payments during financial downturns, safeguarding your personal credit rating.

Find a Trusted Lender

While the interplay between business loans and personal credit is complex, it’s navigable with the right knowledge and practices. At the end of the day, your choice of lender can make a substantial difference in your business loan’s long-term impact.

Blue Copper Capital stands as an ethical lender, committed to transparent and fair lending practices. Our suite of financial solutions is designed to empower entrepreneurs without compromising their personal credit. Contact us today to learn more.