When thinking about your financial goals, consider adding “improve my credit score” to the list.

A good credit score can significantly impact your credit availability, the likelihood of qualifying for a personal or business loan, line of credit, and getting the best interest rates.

Simply put, your credit score could save you money in the long run or cost you just as much.

Depending on your starting point, the time it takes to see improvements can vary. You can begin on the right track to a better credit score by understanding how it’s calculated, the factors that influence it, and practicing ways to improve it.

What is a Credit Score & How Does it Work?

Your credit score is a number based on the information in your credit report. It indicates how well you’ve handled credit in the past, how likely you’ll pay back a loan on time, and the potential risk to lenders.

In Canada, a credit score ranges between 300-900. Generally, the following guideline is a good indicator of your score:

- Excellent: 760+

- Very Good: 725–759

- Good: 660–724

- Fair: 600–659

- Poor: below 560

A poor credit score may result in paying a higher interest rate or being denied credit. In general, missed payments or accounts sent to a collection agency remain in your credit report for 6 years.

Lenders, banks issuing credit cards, car dealerships, or mortgage companies will look at your credit score to decide how much they are willing to lend and at what interest rate. The better the score, the better rate you will get.

How Long Does it Take to See Improvements?

How long it takes to see your credit score go up depends on a few factors. If you’re just starting your credit journey and have little credit history, you can see improvements in a matter of months.

If your credit score has been greatly affected by many missed payments or bankruptcy, improvements may take a few years. Bank Rates estimates it will take this long to see improvements:

- Bankruptcy: 6+ years

- Home foreclosure: 3 years

- Missed payment: 18 months

- Late mortgage payment: 9 months

- Closing credit card account: 3 months

- Maxed credit card account: 3 months

- Applying for a new credit card: 3 months

Factors That Influence Your Credit Score & How It’s Calculated

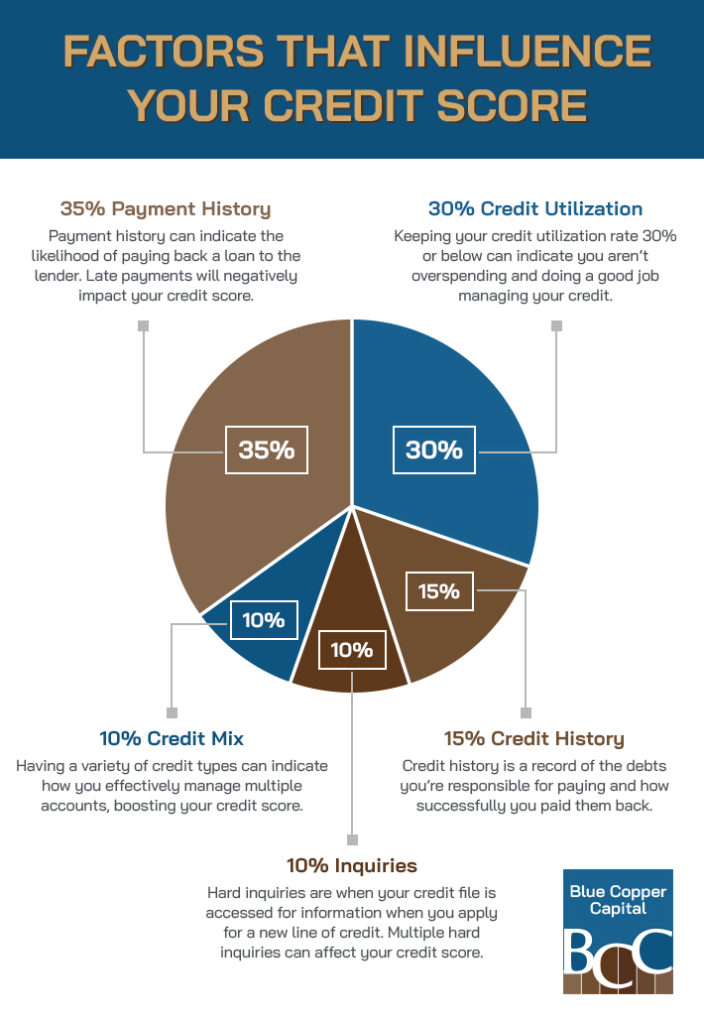

When it comes to calculating your credit score, the breakdown of influencing factors is as follows:

- 35% = payment history

- 30% = credit utilization

- 15% = credit history

- 10% = credit mix

- 10% = inquiries

Payment History (35%)

Lenders will look at your payment history to determine the likelihood of you paying back a loan.

If you have a history of making your payments on time, your credit score will not be affected. If you have a history of not paying back your debts on time, the longer it takes, the more it impacts your score. Having missed payments on your report can take around 18 months to see improvements in your credit score.

Missed payments include any late or missed payments on your credit card or other accounts, such as cell phone bill, mortgage, or loans.

If your account goes through the collections process, which gets reported to the national credit bureaus, it makes it tougher to get loans in the future.

Credit Utilization (30%)

Credit utilization is a ratio of the amount you currently owe to your total credit limit. A good credit utilization rate can indicate you aren’t overspending and doing a good job managing your credit. It’s often recommended to keep your credit utilization rate 30% or below.

For example, if your total credit limit is $10,000, your balance shouldn’t exceed $3000.

Credit History (15%)

Your credit score factors in your credit history. This includes how long you’ve been using credit, how many and what types of credit accounts you have, how long each account has been open, and the success of paying the money back in time.

Whether you have a long or short credit history, you can achieve a good credit score as long as you have been on time with your payments.

Credit Mix (10%)

Credit mix refers to the types of accounts you have. This can include:

- Mortgages

- Loans

- Credit card accounts

Generally, lenders like to see a diverse credit mix. It’s an indicator of how effectively you manage different credit accounts.

Inquiries (10%)

An inquiry is anytime your credit file is accessed for information. There are two types of inquiries: soft and hard.

Soft inquiries include requests a creditor has made to take a look at your file in order to approve an offer or when you want to check your own credit score. Soft inquiries don’t affect your credit score.

Hard inquiries are when a creditor requests to look at your file when you apply for a new line of credit. Multiple hard inquiries in a short amount of time start to affect your credit score.

Steps You Can Take to Improve Your Credit Score

If your current credit score is low, the good news is there are ways to build it back up. Once you learn and put these practices into motion, you can build an excellent credit score and report.

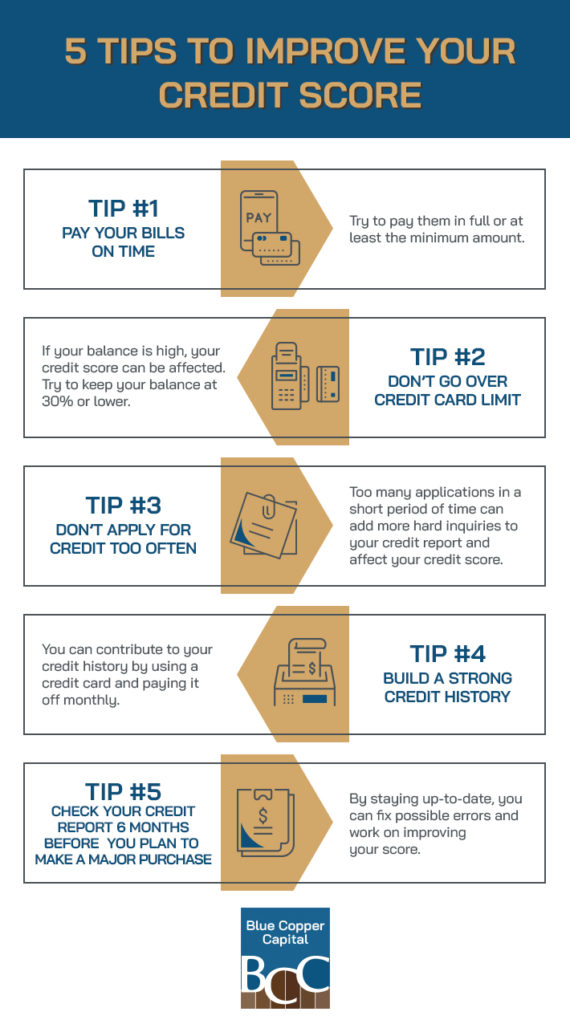

The Government of Canada suggest the following tips to help improve your credit score:

- Pay your bills on time and in full; if you can’t pay in full, try to pay the minimum amount, or you can set up automatic payments.

- Try not to go over your credit card limit; the higher your balance, the more it impacts your credit score.

- Don’t apply for credit too often; too many hard inquiries in a short period of time can affect your credit score.

- Build a strong credit history; if you don’t have a credit history, you can think about using a credit card and paying it off every month.

- Check your credit report 6 months before you plan to make a major purchase that requires a loan, this way, you can resolve errors or make improvements.

Find Financial Success

When you start implementing changes to how you handle your credit and accounts, it’s important to be patient as these improvements take time.

No matter what financial situation you’re in and where your credit score stands, the team at Blue Copper Capital can help. We want to help you achieve your financial goals. If you’re interested in applying for a loan, contact us today!