There are plenty of situations where you might need to look for alternative ways of finding money. You may turn to a payday loan for help, but another good option may be opening a line of credit. Lines of credit are useful for any situation where you need a little extra money, and the system works quite similarly to having a credit card.

But there are different types of lines of credit, and depending on what you need, you may be advised to choose one over the other. Today, we’re going to dive into lines of credit, what they are, what kinds exist, and when you should consider opening up a line of credit.

Of course, every situation is different, so to make sure you’re making the right decision for yourself and your finances, please speak to a financial professional or advisor.

What is a Line of Credit?

Lines of credit is a loan you can get from a bank or other financial institution that is set to a pre-determined limit, generally with no due dates to pay back the entire loan. As long as you don’t max out the credit, you can use as much or as little of it as you like.

Along with the pre-set limit will be an interest rate that you will pay back on the money you use. That’s right; if you use none of the money that’s available in your line of credit, you may not need to pay any interest. The interest is only applied to the money you borrow from it.

Interest rates fluctuate depending on the limit you have and how high your credit score is. Think of your credit score as a “report card” your lenders can look at to determine how risky it is to lend money to you.

Depending on these factors, you may be recommended to get different types of lines of credit, the most common being secured and unsecured.

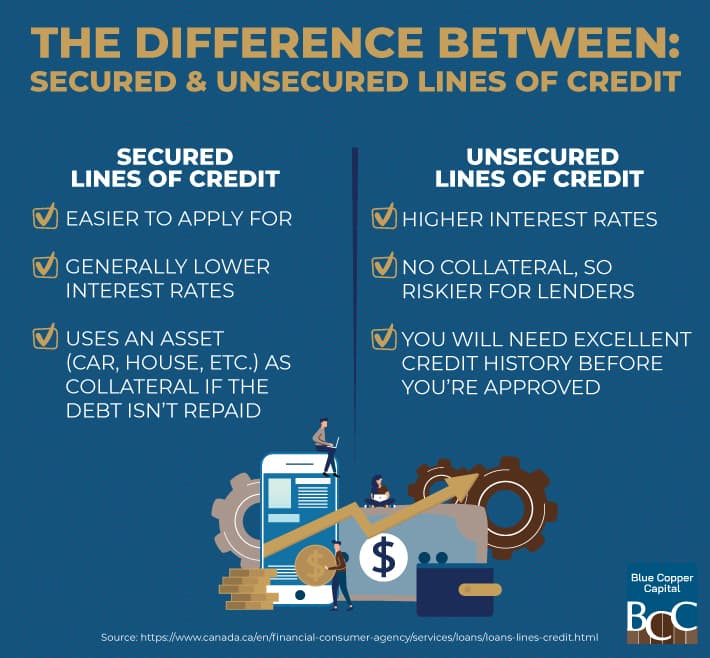

The Difference Between Secured & Unsecured Lines of Credit

Choosing between a secured and unsecured line of credit depends entirely on the funds you’re looking for and your current credit score.

Secured Lines of Credit

Secured lines of credit use your assets as collateral. An asset could be anything like a car or a home, and your lender can take possession of that asset if you fail to pay back what you owe. Typically speaking, secured lines of credit are more attractive to lenders and borrowers because:

- There’s more of a guarantee that you will pay back your debt with collateral.

- The interest rate is lower for borrowers.

Unsecured Lines of Credit

Unsecured lines of credit, also sometimes known as personal lines of credit, have no collateral and often have much higher interest rates for borrowers. These are considered to be more of a risk for the lender and are often much harder to get. For the most part, you will have to have an excellent credit score, a reliable source of income, and a good history of paying back debts before you get approval for an unsecured line of credit.

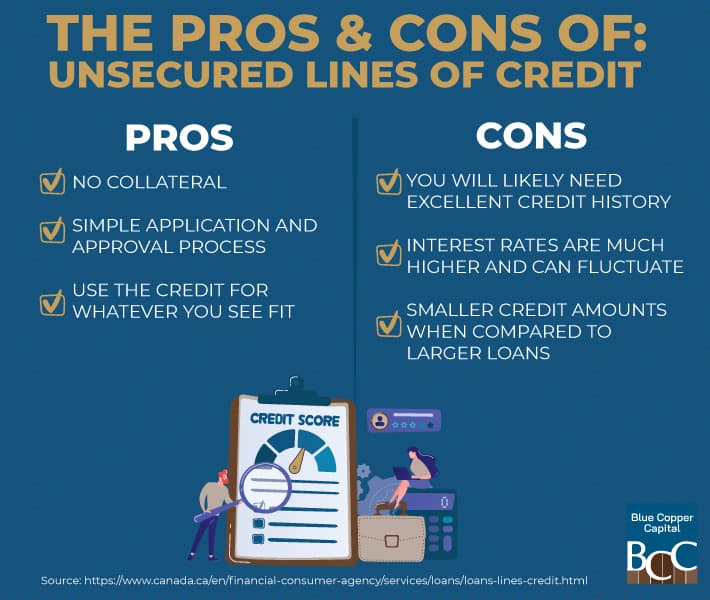

Why Should You Use an Unsecured Line of Credit?

You don’t have to have a specific reason to open up an unsecured line of credit, and your lender won’t place any stipulations on how you spend the money. As long as you’re paying back the money you borrow plus interest, there is no limit to what you can do.

Typically speaking, most people open up unsecured lines of credit to pay for things like post-secondary education, home renovations, or events like weddings and vacations.

Unsecured lines of credit may also be a good option for an emergency if your emergency savings aren’t enough to cover whatever issue you may have.

When To Apply for a Loan Instead

While lines of credit are a type of loan, they do sometimes come with higher interest rates than other loan types. Depending on your goals, you may want to look at a loan if you’re planning on using a large amount of money.

For example, if you’re paying your way through a kitchen renovation, a line of credit may work for you. If you’re planning on buying a house, a loan would likely be a better option.