As the world braces for a possible recession following the COVID-19 pandemic, one of the main concerns for Canadians is the impact on interest rates. With interest rates being a critical factor in determining economic growth, job creation, and inflation, it’s no wonder Canadians are worried about the effects of a recession on their loans, mortgages, and investments.

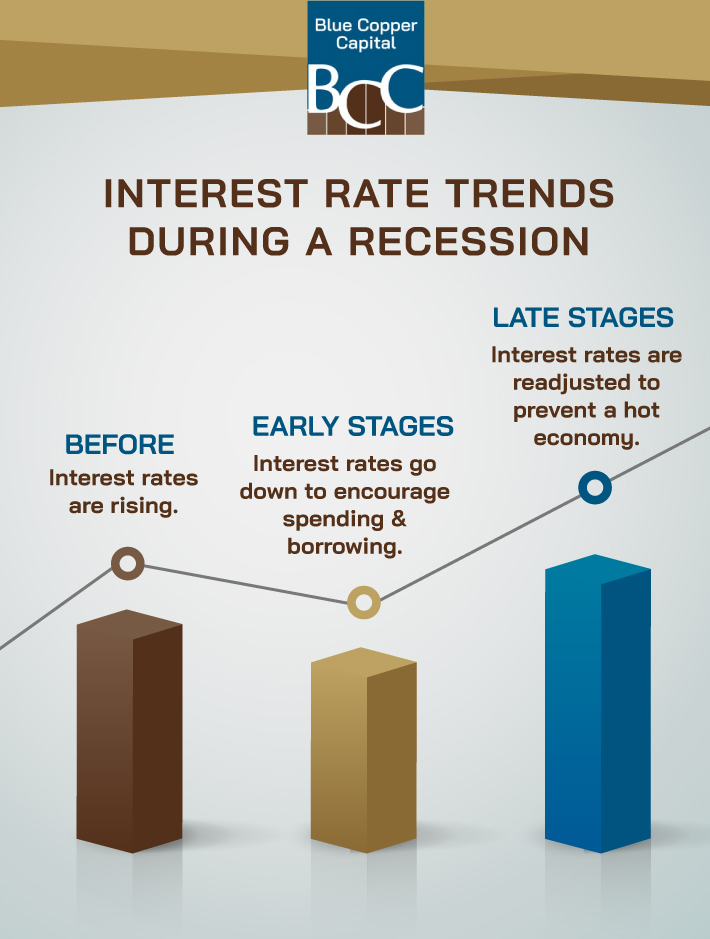

In general, during a recession, interest rates tend to decrease. This is primarily because central banks and financial institutions take measures to stimulate the economy. By lowering interest rates, they aim to encourage borrowing and spending, which can help revive economic activity.

While lower interest rates can be helpful for business owners and people navigating difficult financial times, it’s important to approach borrowing with caution during a recession. Carefully evaluate your financial situation and ability to repay the loan to set yourself up for success once the recession ends and higher interest rates return.

What Is a Recession?

A recession refers to a significant decline in economic activity that lasts for an extended period, averaging about 11 months. Often, when there are 2 consecutive quarters of negative gross domestic product (GDP) growth, economists will declare a recession, but this is not the only determining factor. A variety of factors can lead to a recession, from heightened economic uncertainty to a stock market crash or a global pandemic. While recessions can be a volatile time for investments, they tend to be an inevitable part of the economic cycle.

Recessions have far-reaching effects on the economy and impact the everyday lives of the general public. One notable consequence is increased unemployment rates as businesses face financial constraints and are forced to downsize or close down operations. This often leads to reduced household incomes and lower consumer spending.

Inflation also tends to decrease during recessions due to reduced demand and overall economic slowdown. While this may seem positive, it can lead to deflationary pressures and hinder economic stability. When deflation sets in, it can impact businesses’ profitability, increase the burden of debt, and hinder economic growth.

Will a Recession Affect Interest Rates?

Historically, interest rates have tended to fall during recessions in Canada. The primary reason for this is that central banks, such as the Bank of Canada, often employ monetary policy measures to stimulate economic growth amidst an economic downturn.

However, it’s important to note that each recession presents unique circumstances, and interest rate movements may not always follow historical patterns. Factors such as inflationary pressures, government policies, and global economic dynamics can also influence the decisions central banks make.

As of September 2023, the Bank of Canada has raised its benchmark interest rate to 5% in response to lingering inflationary pressures. This decision shows that the bank is concerned about keeping prices stable and wants to be careful about the potential impacts of a recession. The central bank expects a slowdown in the economy, but they are actively keeping an eye on inflation and excessive demand.

How to Prepare for a Recession

In uncertain economic times, it’s essential to be prepared. By taking proactive steps, you can help safeguard your finances and navigate challenging periods with greater resilience. Some ways you can prepare for a possible recession include building an emergency fund, reducing expenses, paying off high-interest debt, and diversifying your income sources.

Build an Emergency Fund

Having a robust emergency fund is crucial during uncertain times. Aim to save at least 3 to 6 months’ worth of living expenses in a separate account. This fund can act as a safety net to cover essential expenses if your income takes a hit during the recession.

Reduce Debt & Expenses

When a recession is looming, it’s a good time to take a closer look at your expenses and identify areas where you can cut back. Pay down high-interest debt as much as possible. Consolidating high-interest debt may also help alleviate financial strain. By securing a lower interest rate through consolidation, you can free up some cash flow, providing more breathing room in your budget during a time when financial stability may be crucial.

Diversify Your Income Sources

Consider diversifying your income streams to mitigate the impact of a recession. Explore side gigs, freelance opportunities, or start a small business that aligns with your skills and interests. Having multiple sources of income can provide a more stable financial foundation.

Review & Adjust Investments

During a recession, stock markets can experience volatility. It’s important to review your investment portfolio and consult a financial advisor to ensure it aligns with your risk tolerance and long-term financial goals. Diversify your investments across different asset classes to help minimize potential losses. Remember that markets tend to recover over time, so patience is key in this area.

What Happens to Mortgages During a Recession?

One potential positive outcome of a recession is that interest rates often decrease for mortgages. This can create an opportunity for homeowners in Canada to potentially refinance their mortgages at lower rates, resulting in reduced monthly payments and potential savings over the long term.

Recessions can also lead to a decline in real estate prices, making it an opportune time for potential homebuyers or renters. Lower demand and increased housing supply can provide more options and potentially lower prices, making it easier for individuals to enter the real estate market or secure affordable housing options.

Get Financial Help Today

Ultimately, the change in interest rates during a recession depends on the specific circumstances of the economy and the response of central banks. Staying informed, being flexible in financial decision-making, and seeking professional advice can help you navigate the implications of interest rate changes during challenging economic times.

If you’re struggling to keep up with expenses during an economic downturn, personal loans, business loans, and payday loans are available to help. Contact the team at Blue Copper Capital to explore your options and make an informed decision about your financial future.