It’s no secret that many Canadians are facing significant financial challenges. If you’re struggling to repay debt and maintain good credit, you’re not alone. The economic landscape presents hurdles that make it difficult for many to maintain their financial stability.

Rebuilding your credit can take time. With patience and persistence, it is possible. Some of the most useful strategies for rebuilding credit include:

- Establishing a budget

- Paying bills and minimums on time

- Focusing on high-interest debt first

- Consolidating debt

What Is a Good Credit Score?

While the specific ranges can vary slightly depending on the credit scoring model used, a good credit score generally falls within the range of 660–724. This range indicates that you have demonstrated responsible credit behaviour and are likely to meet your financial obligations.

A fair credit score falls within the range of 560–659, suggesting that an individual may have encountered some challenges in maintaining a positive credit history. Lenders may view individuals in this category as slightly higher-risk borrowers.

A credit score below 560 is usually classified as poor. A poor credit score may indicate a history of missed payments, defaults, or other significant credit issues. Individuals with poor credit scores may face difficulties when applying for credit and will be required to pay higher interest rates or provide additional collateral.

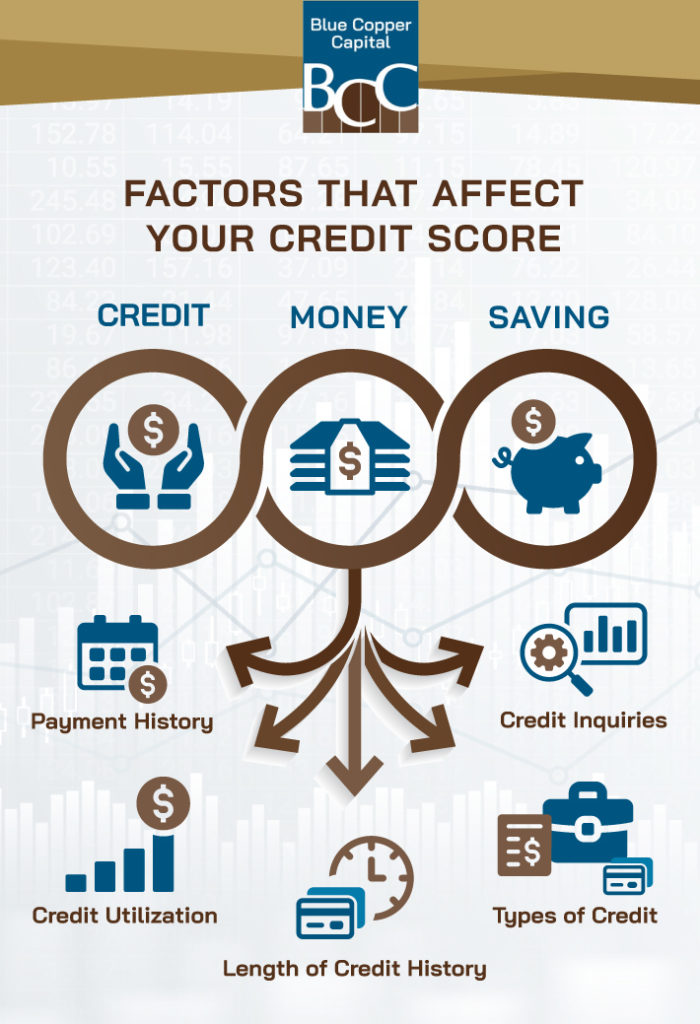

What Affects Your Credit Score?

Understanding your credit score can be crucial when it comes to managing your finances. Your credit score provides lenders with an assessment of your creditworthiness and plays a significant role in determining whether you can qualify for loans, mortgages, or credit cards.

The factors that can influence your credit score include:

- Your credit payment history

- The percentage of credit you use (your credit utilization)

- The length of your credit history

- The types of credit you have

- New and previous credit inquiries

Payment History

Your payment history is one of the most critical factors influencing your credit score. It reflects whether you make your payments on time and in full. Late payments, defaults, or accounts sent to collections can have a negative impact on your credit score. On the other hand, consistently making timely payments can help boost your credit score over time.

Credit Utilization

Credit utilization refers to the percentage of your available credit that you actually use. Keeping your credit utilization low is important for maintaining a healthy credit score. Ideally, it is recommended to keep your credit utilization below 30–35% of your total available credit. High credit utilization can suggest a higher risk of overextending yourself financially.

Length of Credit History

Lenders prefer seeing a longer credit history, as it provides them with more information about your financial behavior. If you are starting to build credit, it may take some time to establish a solid credit history.

Types of Credit

Having a diverse mix of credit accounts, such as credit cards, lines of credit, installment loans, and mortgages, can positively influence your credit score. However, it’s important to note that opening multiple new credit accounts within a short period of time can have a negative effect.

Credit Inquiries

When you apply for new credit, it triggers a hard inquiry on your credit report. Multiple hard inquiries within a short time frame can lower your credit score temporarily. It is recommended to limit the number of new credit applications you make, especially if you’re planning a major financial decision like applying for a mortgage.

How Long Does It Take to Rebuild Credit?

Rebuilding credit is not an overnight task—it requires patience and consistent effort. The timeline for rebuilding credit can be influenced by various factors, such as the severity of past credit issues, the steps taken to address them, and individual financial habits.

In general, it can take several months to see noticeable improvements in your credit score. However, significant credit improvements may take anywhere from 1-3 years or more, depending on individual circumstances. Consistency, discipline, and a long-term outlook are key to achieving sustainable credit improvement.

Strategies for Rebuilding Your Credit

Rebuilding credit may seem like a daunting task, especially when facing financial hardship. However, with the right strategies and a steadfast approach, it is possible to regain control of your credit.

If you’re facing minor financial challenges, implementing these strategies can help jumpstart your credit-rebuilding journey:

- Establish a Budget: Take a close look at your income and expenses to create a realistic budget. Prioritize essential expenses and allocate funds to pay down existing debts.

- Timely Payments: Pay all your bills on time to demonstrate responsible financial behaviour. Consider setting up automatic payments or calendar reminders to avoid late payments.

- Pay Down Debts: Focus on paying off high-interest debts first, such as credit cards. By reducing your overall debt burden, you can improve your credit utilization ratio, positively impacting your credit score.

For those facing more significant financial challenges, these additional strategies can be beneficial:

- Debt Consolidation: Explore options for consolidating your debts into a single loan or credit card with a lower interest rate. Debt consolidation can simplify repayment and may reduce your monthly payment obligations.

- Seek Professional Guidance: Consider working with a reputable credit counselling agency. They can provide personalized advice, help negotiate lower interest rates or payment plans, and offer guidance on managing your finances effectively.

- Secured Credit Cards: If traditional credit cards are out of reach, consider applying for a secured credit card. Secured cards require a cash deposit as collateral, but they can help you build a positive credit history by making timely payments.

For individuals facing severe financial challenges, more involved strategies may be necessary to help jumpstart your credit-rebuilding process.

- Negotiate with Creditors: Contact your creditors and explain your situation. In some cases, they may be willing to negotiate reduced payment plans or settle debts for less than the full amount owed.

- Explore Debt Relief Options: If your financial situation is overwhelming, you may want to explore debt relief options like debt management plans or debt settlement programs. Before pursuing these options, it’s essential to understand their potential impact on your credit score and seek professional advice.

Start Rebuilding Your Credit Today

Rebuilding your credit is a process that requires time and patience. By taking action and making changes, you will increase your credit score. Let us help you get to very good (725 to 759) or excellent (760 and above)! If debt consolidation is one of the strategies you’re considering, Blue Copper Capital can help. Reach out to us today to learn more about our personalized solutions for helping you manage and reduce your debt.