It’s no secret that many Canadians are facing financial challenges, with debt becoming a major concern for a significant portion of the population. This financial strain has left many individuals and families searching for ways to find some extra cash and alleviate their debt burden.

While you can certainly consider personal loans or lines of credit, one potential avenue you may not know about is the possibility of unclaimed bank balances. While they may not hold large sums, every little bit helps.

These could be through a dormant savings account from your childhood, an overlooked checking account, or even an unclaimed deposit or refund. If you’ve moved, changed banks, or forgotten about an account altogether, there’s a chance that you might have unclaimed money waiting for you.

To find out if you have any unclaimed bank balances, you can check the Bank of Canada’s Unclaimed Balances program. This program allows you to search for abandoned money and have it returned to you. You can also search for funds through federally regulated banks and provincial registers.

Understanding Unclaimed Bank Balances

Unclaimed bank balances refer to funds that have been left untouched and forgotten in bank accounts for a significant period of time. This can happen for various reasons, such as inactive accounts, lost account information, or simply being unaware of their existence.

What Happens to Unclaimed Balances?

When an account becomes inactive or dormant for 10 years, and the account holder cannot be contacted, the balance is considered an unclaimed bank balance, and banks have certain protocols they need to follow for those accounts.

Your financial institution should make every effort to contact you before transferring an unowned balance to the Bank of Canada. If your account remains inactive for 2 years or more, your bank will send you notices at specific intervals to the last address they have on file for you. You should receive at least 3 notices before your balance is transferred. These notices appear:

- After 2 years of inactivity

- After 5 years of inactivity

- After 9 years of inactivity

If you have a bank account that has been unused for 2 years, your first notice should arrive in January of the following year, giving you an update on the status of your account.

The notice you receive after 9 years of inactivity is particularly important. It informs you that your balance will be transferred to the Bank of Canada. The transfer takes place in January of the subsequent year if you haven’t contacted your financial institution or used the account by the end of the current year. This notice also provides instructions on how to claim your balance after it has been transferred.

How to Access Your Unclaimed Money

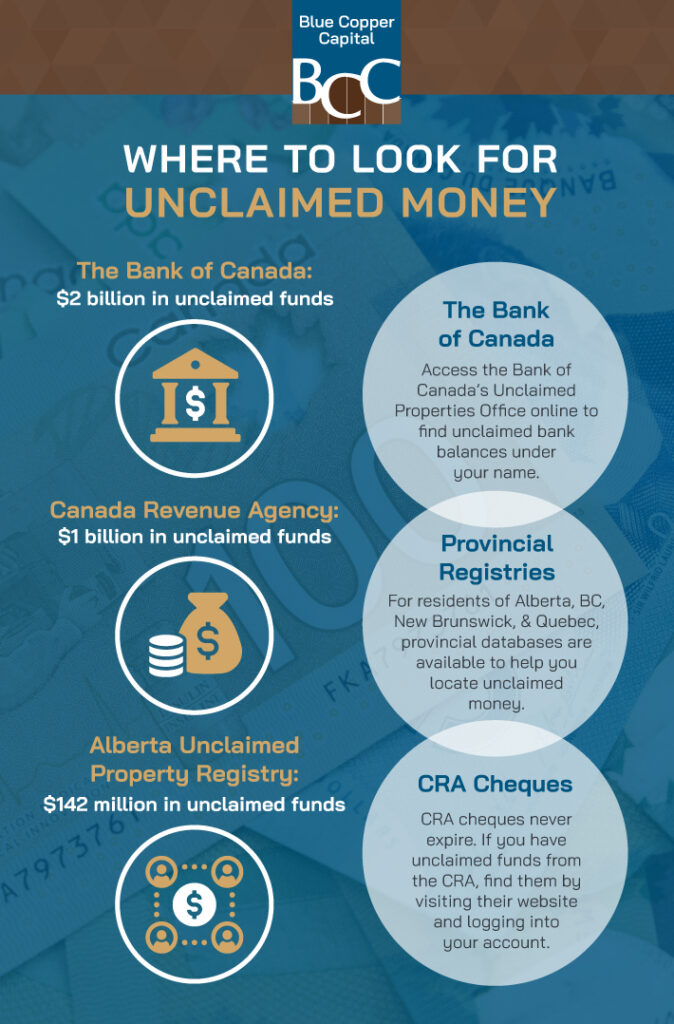

All Canadians can check if they have unclaimed bank balances. One of the primary sources for finding unclaimed money in Canada is the Bank of Canada’s Unclaimed Balances program, but you can also search through banks or provincial databases.

The Bank of Canada

The Bank of Canada holds nearly 2 billion in unclaimed property, so it’s worth the search to see if any of it is rightfully yours. You can access the Bank of Canada’s Abandoned Properties Office online here and use the search function to find unclaimed balances under your name. They hold unclaimed balances of less than $1,000 for 30 years and balances of $1,000 or more for 100 years.

Alberta Unclaimed Property Registry

The Alberta government maintains an abandoned property registry where individuals can search for and claim their lost or forgotten funds. To access this service, you can visit the Alberta government’s official website and use their search tool to check if you have any unclaimed property.

Other Provinces

For residents of British Columbia, New Brunswick, or Quebec, provincial databases are available to help you locate unacknowledged money.

- Residents of BC can take advantage of the BC Unclaimed Property Society’s searchable database.

- New Brunswick just launched its Funds Finder in 2023. You can access their database and search tool here.

- For residents of Quebec, the Register of Unclaimed Property maintained by Revenu Québec is a great resource.

CRA Cheques

There’s a significant amount of dormant funds sitting with the CRA—up to $1 billion—and you might be one of the people who have money waiting for them. Taking the time to check if you have unclaimed CRA cheques can potentially put some extra cash in your pocket.

Simply sign in to your CRA account. Once you’re logged in, look for the “Uncashed Cheques” section. It will provide you with information about any outstanding cheques that haven’t been cashed yet. The great thing about CRA cheques is that they don’t have an expiration date.

Get Financial Support When You Need It

While it’s exciting to find unclaimed money, it may not offer the support you need when you’re struggling to repay debt. If you’re looking for assistance with personal loans, lines of credit, or other financial resources, reach out to our team at Blue Copper Capital. We’re here to provide reliable and ethical loan solutions you can trust.