In a post-pandemic climate marked by inflation and escalating interest rates, many Canadians are embracing buy now, pay later (BNPL) payment plans.

These payment methods are short-term financing plans that allow consumers to pay for purchases in installments (primarily online) instead of the total amount upfront, usually interest-free. For those facing financial constraints, BNPL can help regulate cash flow and allow for purchases.

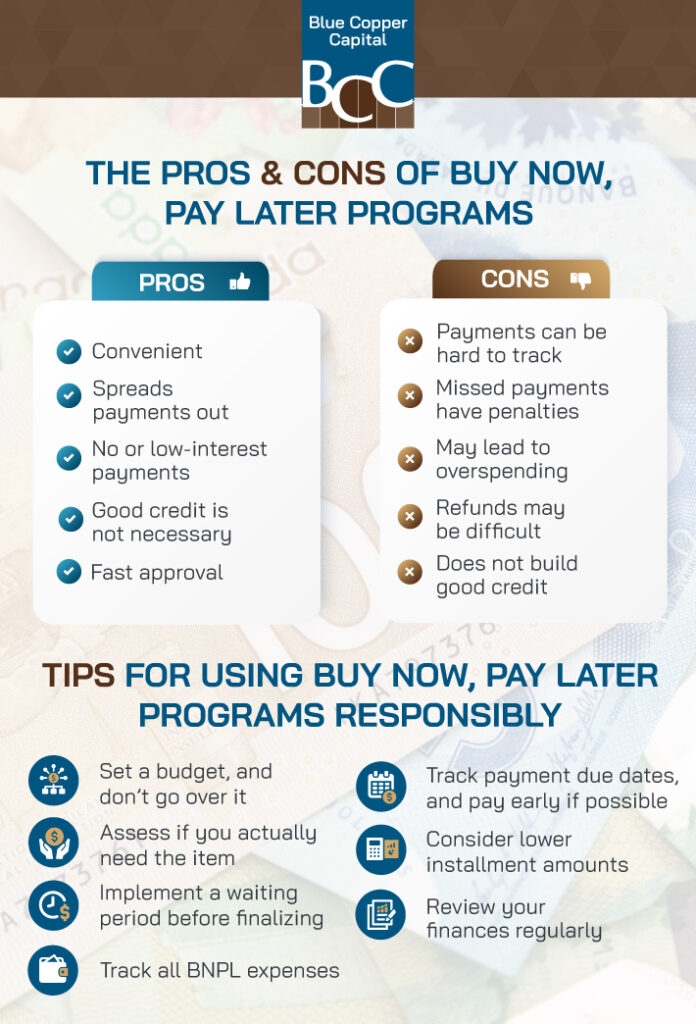

While BNPL is an easy and convenient way to purchase items you need or want without worrying about the immediate financial implications, it doesn’t come without risks. It’s important to understand how these plans work so you can make informed choices for your financial health and budgeting goals.

How Do BNPL Plans Work?

Let’s say you need a new laptop and find one online that will work for you. However, it’s $1,000, and you don’t have the money to pay for it upfront. Fortunately, you see an option to “Pay with 4 interest-free payments of $250.” This amount is much easier to afford now, so you choose this BNPL option and apply for approval.

The approval process requires only minimal personal information and performs a soft credit check. You’re approved, pay $250 (plus GST) immediately (like a down payment), and order your laptop for a quarter of the purchase price.

Depending on the retailer, you can pay off the balance in these smaller installments over a set period, usually 6 to 12 months—repayment schedules vary from retailer to retailer. Some payments can be as low as $10, while others can be $100 or more every week or bi-weekly, depending on the initial purchase price.

In the end, you’ll receive your new laptop right away, and as long as you make your payments on time, you won’t have to pay interest on the balance.

What Happens if You Miss a Payment?

Even though most BNPL programs offer interest-free installment plans, there are often penalties if you miss a payment, including interest, late fees, or suspended accounts, although they vary depending on the provider and terms of the agreement. For example:

- Afterpay may temporarily pause your account if you miss payments. They cap late fees at 25% of the purchase value.

- PayBright doesn’t charge late fees, but they will prevent future purchases if you miss payments.

- Sezzle charges late fees and may restrict your account access if you miss payments.

- Klarna charges late fees and may report your missed payments to credit bureaus.

What Are the Hidden Costs of BNPL?

Like any payment plan, there are inherent risks with BNPL outside penalties for late or missed payments.

Transaction fees, application fees, and late or missed-payment penalties can make the item you purchased cost more in the long run and may affect your credit rating.

The convenience of BNPL plans can also tempt us to overspend by making it easy to purchase items beyond our budget. Being able to make purchases even without the available funds can encourage impulsive buying and result in accumulating unmanageable debt.

Signing up for multiple BNPL plans can also make budgeting difficult. With a predetermined payment plan, you may be unable to adjust your payments based on your income or expenses, leading to financial strain, especially for those living paycheck to paycheck.

All this financial strain can impact your mental health, leading to anxiety and depression.

Tips for Successfully Using BNPL

Whether or not to use a BNPL plan depends entirely on your financial situation. Here are some tips on managing BNPL programs.

Choose Reliable Merchants

With so many merchants offering BNPL payment plans, some may not be trustworthy. Avoid merchants that charge high interest rates or penalties for late payments.

Only Buy What You Can Afford

Don’t spend anything above what you can afford to pay back, and avoid buying things you don’t need or could otherwise wait. Refrain from buying items just because there’s an immediate option to pay later.

Some consumers are using BNPL plans for smaller purchases when they’re historically used for larger, more expensive purchases. This habit can become dangerous if you don’t plan how to repay these loans.

Keep Track of Your Payments

It’s essential to keep track of your payment due dates and payment schedules for each purchase. Set reminders for each payment date to avoid missing one, hurting your credit score, or incurring extra fees. Take your time and budget accordingly to make each payment on time.

Plan for Emergencies

Even with a well-thought-out plan to repay your BNPL loan, you might end up in a situation where you’re unable to make your payments due to unforeseen circumstances like a medical emergency, job loss, or an unexpected expense.

In these situations, contact the merchant as soon as possible to let them know about your situation. Some BNPL programs offer payment deferments or leniency arrangements in cases like these.

Know When to Stop

As you use BNPL plans, keep close tabs on your spending and borrowing. Set a limit so you know when to stop buying and create a budget for future payments. Refrain from letting the convenience of a payment plan trick you into taking on unnecessary debt.

Is a BNPL Plan Right for Me?

The decision to use BNPL programs depends on your financial situation and how well you manage your payments. If you’re confident you can make the payments on time and within the terms, BNPL can be a convenient option. However, if there’s any doubt about meeting payment deadlines or sticking to the repayment plan, it might be wise to avoid BNPL to prevent potential financial strain or penalties.

BNPL plans are only one option out of many to help you pay for needed items or services. At Blue Copper Capital, we’re in the business of helping families achieve their financial goals. If you’re looking for advice or need help with personal or business loans or lines of credit, we’re here for you. Contact us today to speak with one of our representatives about the many financial options we offer.