When you think of credit, what comes to mind? For many, it’s a credit card. And while credit cards are great for various reasons, there are other forms of credit you can look for. A line of credit might be a better choice for you and your financial situation.

Lines of credit operate similarly to credit cards but with a few unique advantages that can make them more attractive to prospective borrowers. However, these advantages can make them more difficult to secure and often require a solid credit history and a good relationship with your bank or lender.

Today, we’ll look at lines of credit, their pros and cons, and what you can do to qualify for one.

However, there is much more to a line of credit than we can cover in a single post. For a complete rundown on lines of credit and how you can leverage them to your advantage, speak to the team at Blue Copper Capital today.

What Is a Line of Credit?

So, what is a line of credit?

According to the Canadian Government, “a line of credit is a type of loan that lets you borrow money up to a pre-set limit.” You don’t have to use the money you get towards a specific purchase, and you can typically pay back the loan whenever it makes sense for you, but you will have to make minimum monthly payments, including the interest.

Lines of credit typically have variable interest rates, meaning they can go up or down while you have the loan. Your lender will determine your interest rate based on:

- Your credit score

- Your credit report

- Your current amount of debt

- Your income

- The type of line of credit you use

That’s right; there are multiple types of lines of credit. Depending on your needs, goals, and current financial situation, your lender or financial advisor can walk you through the different types of lines of credit available and help you determine which would be best for you.

There are 2 main lines of credit: secured and unsecured.

Secured Line of Credit

To get a secured line of credit, you’ll need to use an asset as collateral for your lender. This ensures that if you fail to keep up with your monthly payments, the lender will have the legal right to seize that asset to help make up for any money lost from the loan they provide.

However, secured credit lines can help you with higher credit limits and lower interest rates.

One of the most common secured lines of credit available is a home equity line of credit, also known as a HELOC.

Home Equity Line of Credit (HELOC)

Your home secures a home equity line of credit. HELOCs typically yield a higher credit limit than other secured loans, but the drawback is that your lender can seize your house if you fail to make the appropriate payments.

Unsecured Line of Credit

Unsecured lines of credit, on the other hand, only have a form of collateral for your lender to depend on if you pay your loan back. Although this may be more attractive for a borrower, these lines of credit typically have lower credit limits and higher interest rates. In some cases, getting approved for an unsecured line of credit may be more difficult.

The 2 most common include personal and student lines of credit.

Personal Line of Credit

Personal lines of credit are for, you guessed it, personal use. You may use them for emergencies or help consolidate higher-interest loans, but you may use them however you wish.

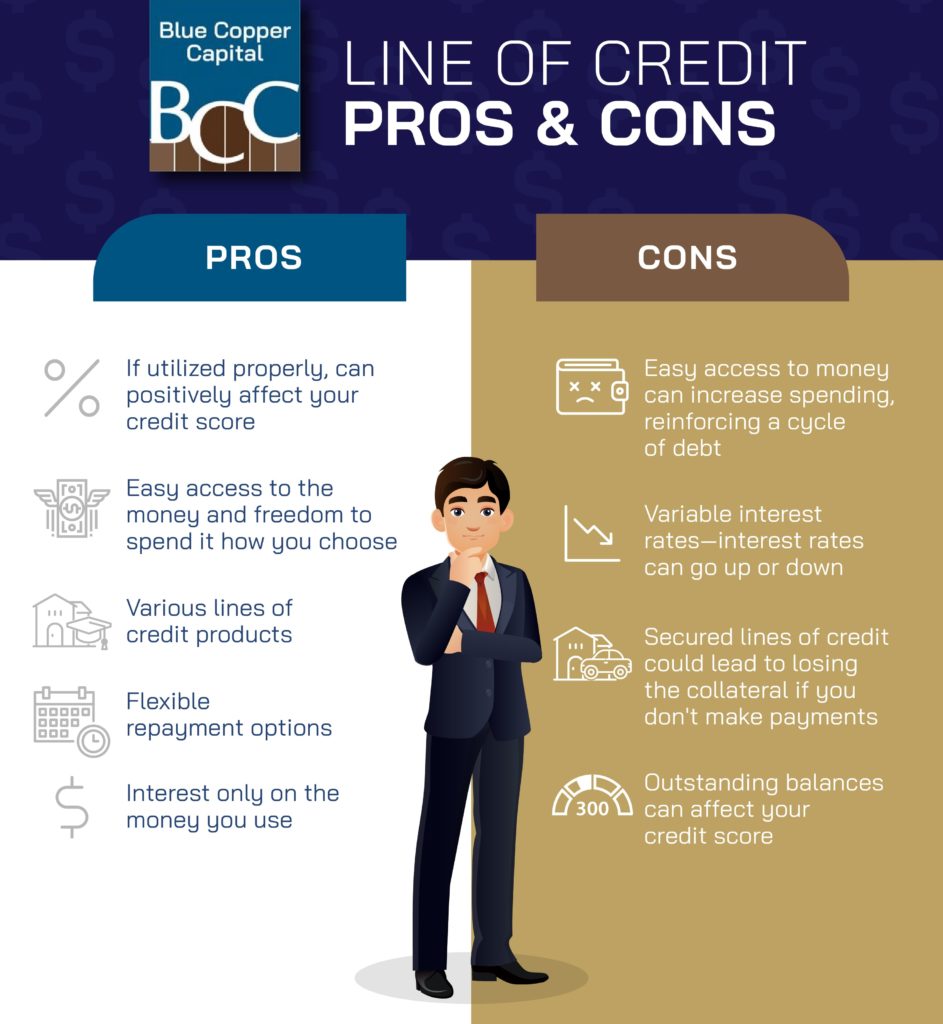

Pros & Cons of Having a Line of Credit

Now that we have a solid understanding of what a line of credit is, let’s look at some of the pros and cons you might encounter when considering this type of loan.

Pros

- Lower interest rates than credit cards and personal loans

- Easy access to the money and freedom to spend it how you choose

- Various lines of credit products

- Flexible repayment options

- Interest only on the money you use

Cons

- Easy access to money can increase spending, reinforcing a cycle of debt

- Variable interest rates—interest rates can go up or down

- Secured lines of credit could lead to losing the collateral if you don’t make payments

- Outstanding balances can affect your credit score

How Do You Qualify?

So, how do you qualify for a line of credit?

It comes down to your credit history, income, and ability to pay back the loan. Wherever you go to apply for the loan, your lender will take a detailed look at your financial history to determine if you’re someone they feel safe to open a line of credit with.

You can visit your bank to open the line of credit or check out a credit union or virtually any reputable financial institution to see if they’d be willing to work with you. Depending on the line of credit product you’re looking at opening, the lender will look at your:

- Household income

- Assets and liabilities

- Credit score and credit history

- Employment stability

- Home value

Each of these variables will determine what line of credit might work best for you, your credit limit, and your initial interest rate.

Once your lender approves you for a line of credit, it will then be your responsibility to keep up with your monthly payments. Ensure you make your payments to avoid losing your collateral asset or significantly affecting your credit history.

Interested in a Line of Credit?

If you’re wondering how a line of credit can help you achieve your financial goals, please get in touch with the Blue Copper Capital team today.